[ad_1]

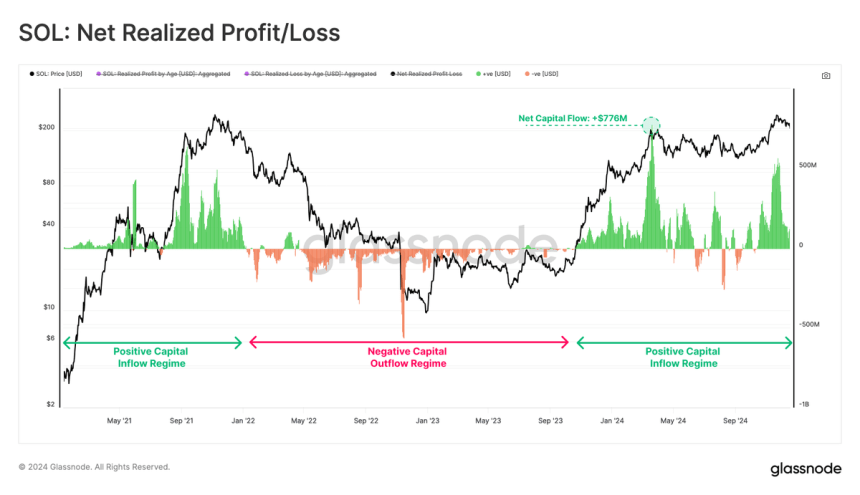

Solana has staged a powerful restoration, surging over 14% from its latest native lows, showcasing resilience after a interval of correction. This renewed momentum has reignited investor optimism, positioning Solana as a standout within the crypto market. Key metrics from Glassnode additional bolster this sentiment, revealing that Solana has persistently maintained a constructive web capital influx since early September 2023. Whereas minor outflows had been noticed, the general development underscores sustained curiosity and confidence within the mission.

Associated Studying

These capital inflows spotlight Solana’s rising adoption and utility, indicating that the blockchain ecosystem continues to draw new contributors and capital. Because the market evolves, such metrics counsel that Solana is poised for continued progress, supported by sturdy fundamentals and a thriving developer neighborhood.

With its restoration gaining traction, Solana stays a high contender for traders eyeing initiatives with sturdy long-term potential. The constant influx of capital not solely displays market confidence but additionally units the stage for additional enlargement within the coming months. Whether or not by modern dApps, enhanced scalability, or rising community exercise, Solana’s upward trajectory appears removed from over, making it a focus within the broader crypto panorama.

Solana Metrics Reveal A Rising Community

Solana seems to be on the point of an enormous rally subsequent yr as its community continues to exhibit sustained progress and resilience. In line with an insightful report by Glassnode, Solana has persistently recorded constructive web capital inflows since early September 2023. Regardless of minor outflows throughout this era, the general development highlights the community’s skill to draw liquidity and keep investor confidence.

One of many report’s most hanging revelations is the height each day influx of $776 million in new capital, underscoring vital curiosity and participation inside the ecosystem. This sustained inflow of liquidity has not solely bolstered Solana’s progress however has additionally performed a pivotal position in supporting its value stability and appreciation. Such a constant capital influx means that traders view Solana as a high-potential mission able to outperforming within the coming months.

Associated Studying

With sturdy fundamentals, rising adoption, and rising developer exercise, Solana’s upward trajectory is well-positioned to proceed. If the present development of capital inflows persists, it might function a catalyst for an enormous rally, doubtlessly surpassing earlier highs.

As we stay up for 2025, Solana stays a mission to observe, providing traders a chance to take part in a blockchain ecosystem that’s quickly gaining prominence within the crypto area.

Robust Bounce From Key Demand

Solana (SOL) is presently buying and selling at $199 after efficiently bouncing from the $175 degree, a important demand zone that has confirmed to be a sturdy assist space. This rebound showcases Solana’s underlying power and its skill to draw patrons at key ranges, setting the stage for additional upward momentum. The $175 mark has traditionally acted as a launchpad for SOL, and this time is not any completely different, as the value now targets increased ranges.

If Solana manages to push above the $210 resistance degree within the coming days, a speedy surge is prone to observe. Breaking this barrier would sign sturdy bullish momentum, doubtlessly propelling SOL into new highs and reigniting investor enthusiasm. Nonetheless, the market might additionally expertise a interval of sideways consolidation as merchants assess the present situations and put together for the following vital transfer.

Associated Studying

Consolidation above the $190 degree would nonetheless be a constructive signal, indicating that SOL is constructing a stable basis for its subsequent rally. Sustaining power round these ranges is important to sustaining the bullish outlook, as any failure to carry might result in a retest of decrease demand zones. For now, all eyes are on Solana because it navigates key value ranges and prepares for its subsequent transfer.

Featured picture from Dall-E, chart from TradingView

[ad_2]